区块链运用最好的保险公司排名

Title: Exploring the Top Insurance Companies Utilizing Blockchain Technology

Blockchain technology has emerged as a revolutionary force across various industries, including the insurance sector. Its inherent features of transparency, immutability, and decentralization offer significant advantages for insurance companies, ranging from streamlined operations to enhanced security and fraud prevention. In this article, we will delve into some of the top insurance companies leveraging blockchain technology, highlighting their innovative initiatives and the benefits they offer to both customers and the industry as a whole.

Introduction to Blockchain in Insurance

Blockchain technology, often synonymous with cryptocurrencies like Bitcoin, is essentially a decentralized digital ledger that records transactions across a network of computers. Each transaction, or "block," is linked to the previous one, forming a chronological chain that is immutable and transparent.

In the insurance industry, blockchain is being utilized to address various pain points, including fraud detection, claims processing, underwriting, and customer verification. By leveraging blockchain's capabilities, insurance companies can enhance efficiency, reduce costs, and provide better services to policyholders.

Top Insurance Companies Harnessing Blockchain

1. AXA

AXA, one of the world's largest insurance companies, has been at the forefront of blockchain adoption in the industry. The company has implemented blockchain technology in various areas, including flight delay insurance and automatic compensation payouts. By utilizing smart contracts, AXA has streamlined the claims process, enabling faster payouts to customers when their flights are delayed.

2. Allianz

Allianz, another major player in the insurance sector, has been exploring blockchain applications to improve transparency and efficiency. One notable initiative is Allianz's partnership with other insurers and reinsurers to develop a blockchainbased platform for the processing of crossborder insurance payments. This platform aims to simplify and expedite the settlement process while reducing administrative costs.

3. MetLife

MetLife has been experimenting with blockchain technology to enhance the life insurance and annuity sectors. The company has developed solutions for automating processes such as policy issuance and claims settlement, thereby reducing paperwork and accelerating the delivery of services to customers. MetLife's blockchain initiatives focus on increasing transparency and trust in the insurance ecosystem.

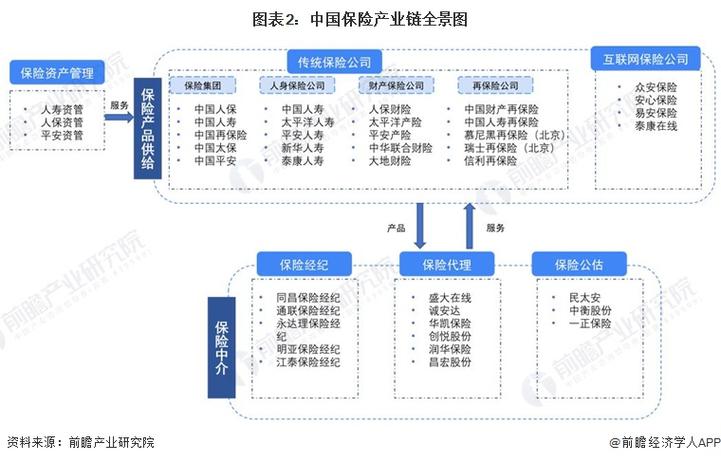

4. Ping An Insurance

Ping An Insurance, one of the largest insurers in China, has made significant investments in blockchain technology. The company has developed a blockchainbased platform called "Ping An Cloud Chain," which offers solutions for insurance, banking, and healthcare industries. Ping An's blockchain applications include fraud prevention, customer identity verification, and supply chain finance, demonstrating the diverse potential of blockchain in insurance.

5. Zurich Insurance Group

Zurich Insurance Group has been exploring blockchain applications to enhance data security and streamline insurance processes. The company has participated in industrywide initiatives to develop blockchain standards and frameworks, aiming to promote interoperability and scalability in the insurance sector. Zurich's blockchain initiatives focus on improving data integrity, enhancing trust among stakeholders, and driving innovation in insurance services.

Benefits of Blockchain Adoption in Insurance

The adoption of blockchain technology offers several benefits for insurance companies, including:

Enhanced Security:

Blockchain's cryptographic techniques ensure that data stored on the ledger is tamperproof and secure, reducing the risk of fraud and unauthorized access.

Improved Efficiency:

By automating manual processes and reducing intermediaries, blockchain streamlines operations, accelerates transactions, and lowers administrative costs for insurance companies.

Transparent Transactions:

Blockchain provides a transparent and auditable record of transactions, enabling greater visibility and accountability across the insurance value chain.

Faster Claims Processing:

Through smart contracts and automated workflows, blockchain facilitates faster claims processing and settlements, leading to improved customer satisfaction.Conclusion

In conclusion, blockchain technology holds immense promise for transforming the insurance industry by addressing key challenges and unlocking new opportunities for innovation. Leading insurance companies, such as AXA, Allianz, MetLife, Ping An Insurance, and Zurich Insurance Group, are leveraging blockchain to enhance security, efficiency, and transparency in their operations. As blockchain continues to evolve and mature, we can expect to see further adoption and integration across the insurance ecosystem, ultimately benefiting both insurers and policyholders alike.

References:

1. AXA. (n.d.). Blockchain at AXA.

2. Allianz. (n.d.). Blockchain and Distributed Ledger Technology.

3. MetLife. (n.d.). Blockchain Innovation at MetLife.

4. Ping An Insurance. (n.d.). Ping An Cloud Chain.

5. Zurich Insurance Group. (n.d.). Blockchain in Insurance.